Mon, Sep 4, 2023

Brazil Transactions Insights – Summer 2023

M&A Market Overview

M&A activity in Brazil in the first half of 2023 reached a volume of 661 transactions, representing an 11.8% decrease compared to the same period in 2022. Last twelve months activity remained at same level, having a marginal decrease of 5.8% in the number of announced transactions. Sectors more active are the financial/ insurance (and with a tech angle), technology, health services and equipment and food and beverage.

As IPOs (0) and follow-ons (9) have decreased offers in 2023, Mergers and Acquisitions activity has taken advantage of this scenario and should remain strong. Monthly analysis demonstrates a recent ramp up of activities and that 2023 figures shall remain at same level of 2022.

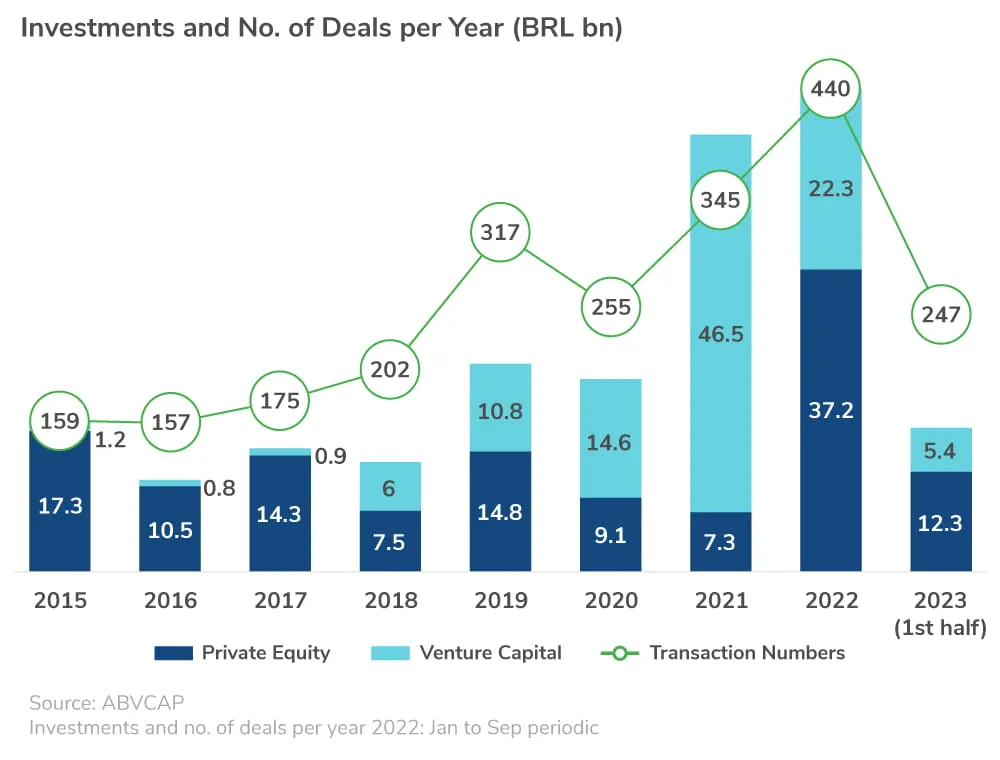

Private Equity and Venture Capital

In 2022, financial investors invested more than BRL 50 bn in Brazil and VCs (given investments in tech verticals) significantly outperformed PEs investment. In the first half of 2023, financial sponsors were present in 34.5% of the transactions, with investments of BRL 17.5 billion (similar to the same period in 2021).

Corporate Finance and Restructuring

M&A advisory, restructuring and insolvency, debt advisory, strategic alternatives, transaction diligence and independent financial opinions.

Mergers and Acquisitions (M&A) Advisory

Kroll’s investment banking practice has extensive experience in M&A deal strategy and structuring, capital raising, transaction advisory services and financial sponsor coverage.